Table of Contents

- What is a Tax Credit Note?

- Latest VAT Law Updates on Tax Credit Notes in the UAE

- Understanding the New UAE VAT Rules on Credit Notes

- Tax Credit Note Example in the UAE

- When is a Tax Credit Note Issued?

- Tax Credit Note Format

- Benefits of Tax Credit Notes under UAE VAT

- How Shuraa Tax Ensures Compliance with Credit Notes and UAE Tax Credit Notes

- FAQs

A credit note is an essential financial document used in business to correct or adjust the value of a transaction without altering the original invoice. Typically issued by a seller to a buyer, a credit note acknowledges that the buyer is entitled to receive a refund, replacement, or a reduction in the amount payable due to reasons such as product returns, damaged goods, overcharging, or service discrepancies.

Beyond serving as proof of the adjustment, a credit note also helps maintain accurate accounting records, ensures compliance with tax regulations, and build trust between businesses and their customers. In modern trade and accounting systems, credit notes have become an integral tool to maintain transparency and streamline financial settlements.

What is a Tax Credit Note?

A credit note is a document issued by a supplier to a buyer to adjust or reduce the value of an invoice that has already been issued. It typically comes into play when goods are returned, services are cancelled, or an overcharge occurs. In the UAE, under Value Added Tax (VAT) regulations, this document is referred to as a UAE Tax Credit Note.

It must follow specific guidelines set by the Federal Tax Authority (FTA). A UAE Tax Credit Note not only corrects the value of the original taxable supply but also ensures that both the supplier and the recipient properly account for the revised VAT amount in their records. This helps maintain transparency, prevents discrepancies in tax reporting, and ensures compliance with UAE VAT laws.

Latest VAT Law Updates on Tax Credit Notes in the UAE

The UAE Federal Tax Authority (FTA) has rolled out important updates to VAT rules governing tax credit notes, changes that every business must keep on their radar. Under the revised law, companies are no longer required to disclose every detail of the original transaction before issuing a tax credit note.

Another major shift: businesses now have the flexibility to cancel a tax credit note at any time, provided it’s done before filing their VAT return. Any such cancellations must be recorded in the company’s books or electronic records to maintain transparency and avoid conflicts with the FTA’s data.

With these new provisions, compliance becomes simpler, but the stakes remain high. Missteps can still lead to significant penalties. Businesses should review their current VAT procedures, update internal controls, and ensure their teams are fully aligned with the latest requirements.

Understanding the New UAE VAT Rules on Credit Notes

The UAE’s VAT framework has taken another step forward with a key amendment impacting how businesses issue credit notes. The latest changes demand not only timely action but also smarter internal processes to ensure full compliance.

1. The New 14-Day Rule – Why It Matters

Under the updated law, companies now have a strict 14-day deadline to issue a UAE Tax Credit Note once an adjustment becomes necessary. Whether it’s the wrong VAT rate applied or an overcharged customer, organisations must respond quickly. This means upgrading accounting systems to automatically flag incorrect transactions and generate a credit note invoice without delay. Proactive firms will integrate these checks directly into their billing workflows rather than relying on manual reviews.

2. Effective from Day One

This isn’t a change to prepare for “someday.” The amendment has been in force since January 1, 2023, and businesses are expected to comply immediately. Late or incorrect issuance of a credit note could expose companies to penalties, so getting professional VAT advice in Dubai is now more critical than ever.

3. What a Tax Credit Note Must Contain

The Federal Tax Authority has outlined a clear checklist to avoid invalid or incomplete notes. Every valid credit note invoice in the UAE must:

- Include the supplier’s name, address, and Tax Registration Number (TRN).

- Provide enough information to link back to the original supply or supplier.

- Display the title “Tax Credit Note.”

- State the date of issue.

- Explain why the invoice note was issued.

- Show the original invoice value, the corrected amount, and the VAT difference.

- Include the recipient’s details and TRN if they are VAT-registered.

4. What Businesses Should Do Now

This isn’t just about paperwork; it’s about maintaining credibility with the tax authorities and avoiding expensive disputes. Companies should:

- Update ERP or accounting software to comply with the new rules.

- Audit their current invoicing processes.

- Train finance teams to recognise when a UAE Tax Credit Note is required.

- Seek ongoing advice from VAT consultants to handle complex cases.

By treating credit notes as more than a correction tool, but as a core compliance requirement, businesses can stay ahead of regulatory changes while ensuring smooth VAT reporting.

Tax Credit Note Example in the UAE

A Tax Credit Note under VAT is issued by a supplier when the value of an original supply is reduced due to reasons such as product returns, discounts, or errors in the invoice. It ensures that the supplier adjusts the VAT charged and the buyer claims the correct tax amount.

Credit invoice example:

Suppose a company in Dubai sells goods worth AED 10,000 plus 5% VAT (AED 500), making the total invoice value AED 10,500. Later, the customer returns goods worth AED 2,000. The supplier must issue a Tax Credit Note to reduce the taxable value:

- Original invoice amount: AED 10,000 + AED 500 VAT = AED 10,500

- Returned goods value: AED 2,000 + AED 100 VAT = AED 2,100

- Tax Credit Note issued: AED 2,100 to adjust the VAT and supply value

This process ensures both parties remain VAT compliant while maintaining accurate records.

When is a Tax Credit Note Issued?

In the UAE, a Tax Credit Note is issued when a business needs to adjust or reduce the value of a previously issued tax invoice under VAT law. This usually happens when:

- The customer returns goods: e.g., faulty or unwanted items.

- Services are cancelled or reduced: e.g., the scope of work changes after invoicing.

- An error in the original tax invoice, such as overcharging or applying the wrong VAT rate.

- Post-supply discounts are given: if a discount was not reflected in the original invoice.

According to UAE VAT regulations, a Tax Credit Note must be issued within 14 days from the date the business becomes aware of the need for adjustment. This ensures VAT records remain accurate and compliant.

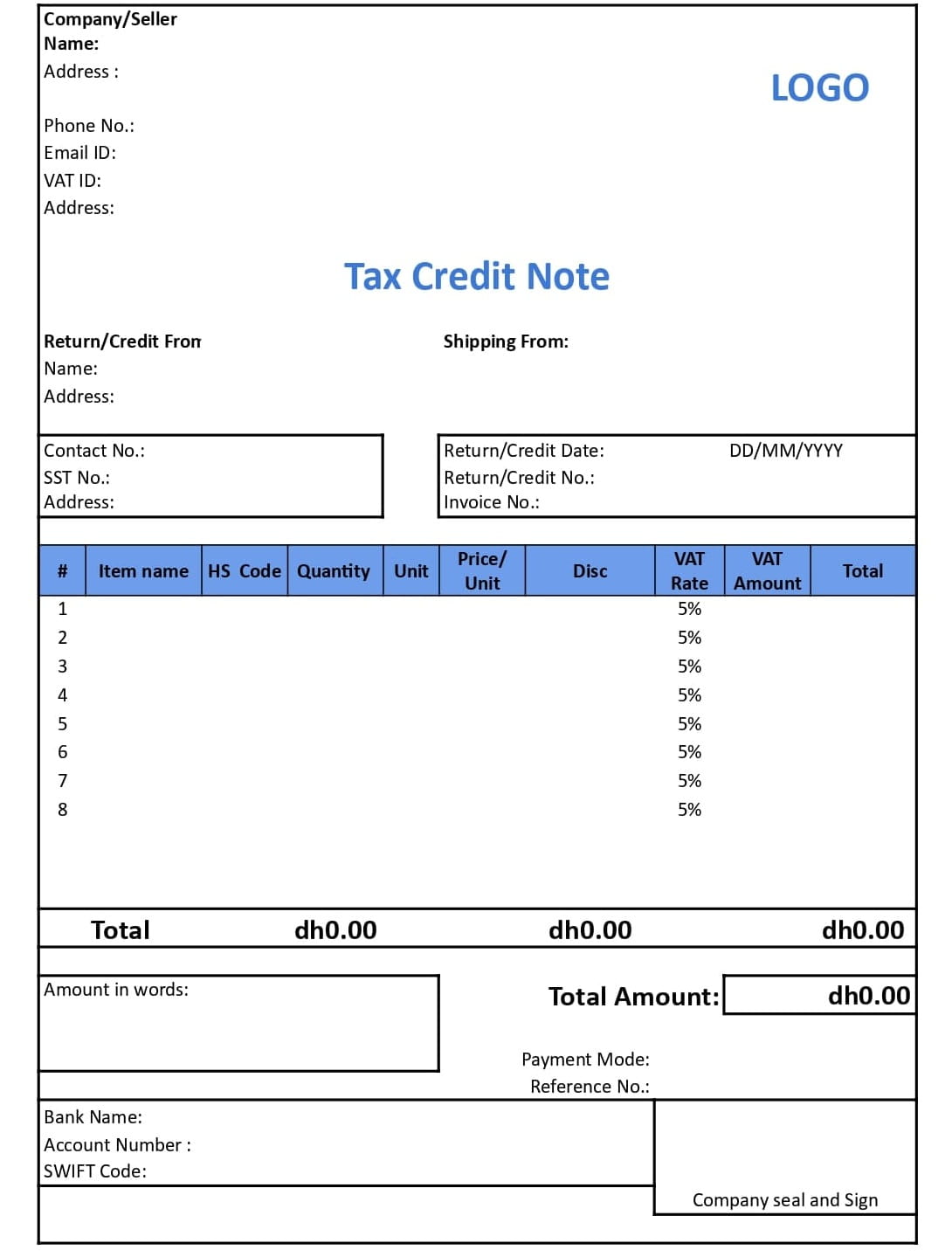

Tax Credit Note Format

Here’s a sample tax credit note from the UAE, fully aligned with VAT regulations.

Benefits of Tax Credit Notes under UAE VAT

Below are the benefits of tax credit notes under UAE VAT:

1. Reduction in VAT Liability for Suppliers

Tax Credit Notes allow suppliers to correct previously issued invoices by reducing the VAT amount owed to the Federal Tax Authority (FTA). These adjustments might arise due to product returns, post-sale discounts, or invoice errors. This correction ensures businesses don’t overpay VAT.

2. Input Tax Adjustment Benefit for VAT-Registered Recipients

If the recipient is also VAT-registered, the Tax Credit Note enables them to decrease their claimed input tax, aligning with the corrected taxable amount.

3. Improved Cash Flow

By avoiding overpayment of VAT, businesses can retain funds that would otherwise be held until refunds are processed or adjustments confirmed—enhancing liquidity.

4. Enhanced Accuracy and Error Reduction

Tax Credit Notes serve as a clean and systematic way to amend billing errors, such as overcharges or wrong VAT calculations, without generating new invoices or complicated manual adjustments.

5. Regulatory Compliance and Audit Readiness

Using Tax Credit Notes in alignment with FTA rules ensures proper documentation and reduces the risk of penalties during audits.

6. Customer Trust & Satisfaction

For returns or price adjustments, Tax Credit Notes provide transparency and fairness, reinforcing trust between businesses and their customers.

7. Supports Electronic Record-Keeping & E-Invoicing

Electronic Tax Credit Notes are encouraged, when issued via approved digital systems, they’re secure, tamper-evident, and seamlessly integrated into accounting workflows.

8. Simplifies Complex Transactions

Under Cabinet Decision No. 81 of 2023, businesses can combine tax invoices and credit notes within a single document labelled “Tax Invoice/Tax Credit Note,” reducing administrative burden without compromising clarity.

How Shuraa Tax Ensures Compliance with Credit Notes and UAE Tax Credit Notes

A credit note, whether a simple adjustment tool or a formal UAE Tax Credit Note under VAT is far more than just an invoice note issued against errors or returns. It safeguards accurate financial records, ensures VAT compliance, and maintains transparency in every business transaction. Whether you’re issuing a credit note invoice, reconciling a credit note against invoice, or referring to a credit invoice example, precision and timely action are non-negotiable under UAE law.

With the Federal Tax Authority’s updated 14-day rule and evolving VAT framework, businesses can no longer rely on manual checks or outdated processes. Non-compliance, even if unintentional, can trigger penalties and disrupt cash flow. That’s why proactive measures, like automating credit note workflows, training finance teams, and auditing VAT processes, are critical.

Shuraa Tax can help you navigate these requirements with ease. From ensuring every Tax Credit Note under VAT meets FTA standards to streamlining your accounting systems for error-free reporting, their experts make compliance seamless. Whether you need guidance on issuing a credit note invoice, structuring a credit note against invoice, or understanding a detailed credit invoice example, Shuraa Tax offers the clarity and precision your business deserves.

Get expert VAT support today:

Call: +(971) 44081900

WhatsApp: +(971) 508912062

Email: info@shuraatax.com

By treating credit notes as a compliance asset not just a correction tool you’ll protect your business, improve liquidity, and build lasting trust with both customers and regulators.

FAQs

1. What is a Tax Credit Note under UAE VAT?

A Tax Credit Note is a document issued by a supplier to adjust or reduce the value of a previously issued tax invoice. It is typically used when goods are returned, services are cancelled, discounts are applied after invoicing, or errors are found in the original invoice. The note ensures VAT adjustments are correctly reflected in both supplier and buyer records.

2. When can a Tax Credit Note be issued in the UAE?

As per Federal Tax Authority (FTA) regulations, a Tax Credit Note must be issued within 14 days from the date the supplier becomes aware of the adjustment requirement. This ensures VAT records remain accurate and compliant with UAE law.

3. What details must a valid UAE Tax Credit Note contain?

A valid Tax Credit Note must include:

- Supplier’s name, address, and Tax Registration Number (TRN).

- Recipient’s details and TRN (if VAT registered).

- Title “Tax Credit Note.”

- Date of issue.

- Reason for issuing the note.

- Original invoice value, corrected amount, and VAT adjustment.

- Reference to the original supply or invoice.

4. What are the benefits of issuing a Tax Credit Note?

Tax Credit Notes ensure:

- Reduction in VAT liability for suppliers.

- Correct input tax adjustment for buyers.

- Improved cash flow by avoiding VAT overpayment.

- Error-free records for audits and compliance.

- Transparency and stronger customer trust.

5. What happens if a Tax Credit Note is not issued correctly or on time?

Failure to issue a Tax Credit Note within the 14-day deadline, or providing incomplete details, may result in FTA penalties, incorrect VAT reporting, and potential disputes with customers. Businesses should upgrade their accounting systems and train finance teams to avoid such risks.